Caribbean De-Risking

The Caribbean is facing a major emerging challenge, aptly referred to as the correspondent banking crisis.

The manifestations of the problem, which deepened after the 2008 global financial crisis, have resulted in the restriction of services from large international banks or closing of accounts belonging to several financial entities, such as domestic banks and money transfer businesses globally, but disproportionately negatively affecting developing regions of the world.

FAQ

Correspondent banks provide the Caribbean with vital access to the international financial system.

Answered questionsWhat’s New

Chairman’s Statement at the conclusion of the Global Conference on Correspondent Banking, de-risking and the labelling of the Caribbean as a tax haven Antigua and Barbuda.

News pagePublications

Latest News

Explainer: Why is Jamaica leaving...

bout two weeks ago, from June 26-28, 2024, the global body...

FATF REMOVES JAMAICA FROM GREY...

The Minister of Finance and the Public Service, Dr. the...

Caribbean countries against one size...

Caribbean leaders met with a delegation from the United States House...

Caribbean takes issue with western...

If there was a rating agency at the Congressional session...

De-Risking Challenges Discussed At Special...

Prime Minister Mia Amor Mottley has informed a specially convened...

Offshore Bank Accounts In The...

Caribbean banks are really popular with non-residents as they provide...

Caribbean Banking in 2022-2023: Overview

Is the Caribbean banking still good in 2022-2023? Yes, it...

Caribbean – How Much of...

Financial de-risking in the Caribbean: The US implications and what...

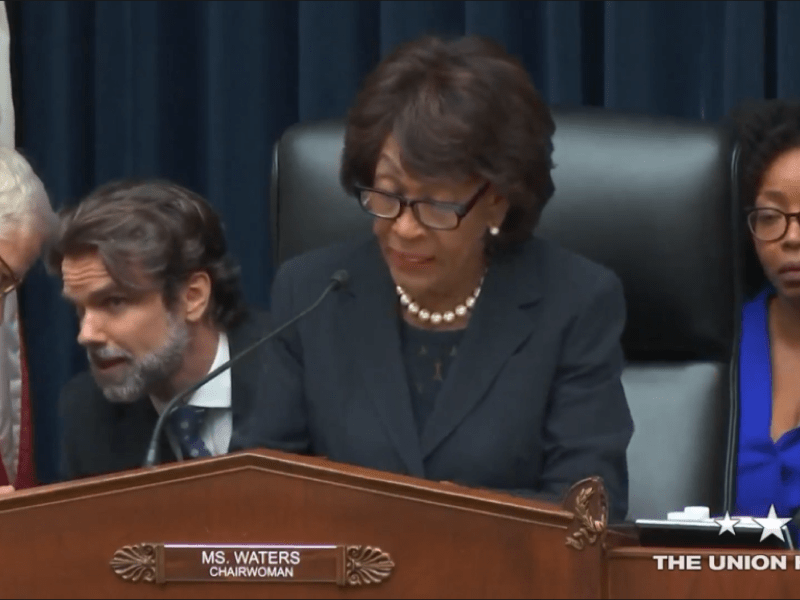

House Financial Services Hearing on...

299 views 14 Sept 2022 House of Representatives Committee on...

PM Calls for More Collaboration...

Take Down The Walls That Separate US – Mottley…As the...